Leading Equity Loans for House Owners: Get the most effective Rates

Leading Equity Loans for House Owners: Get the most effective Rates

Blog Article

Utilize Your Home's Value: The Benefits of an Equity Lending

When considering financial alternatives, leveraging your home's value with an equity car loan can provide a tactical method to accessing additional funds. From versatility in fund use to possible tax advantages, equity finances provide a possibility worth exploring for house owners seeking to enhance their economic sources.

Advantages of Equity Loans

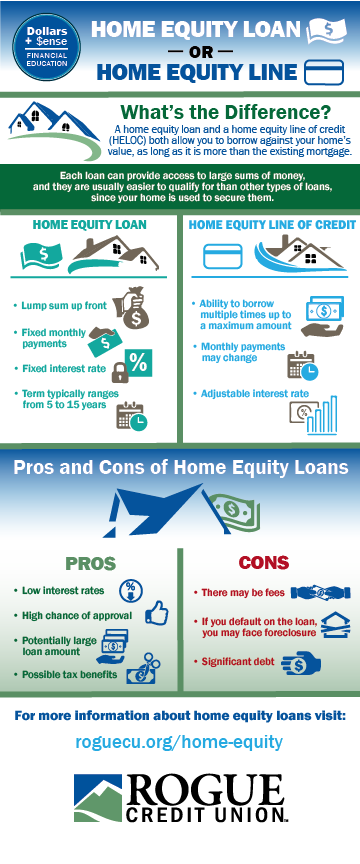

One of the primary advantages of an equity lending is the capacity to access a large amount of money based upon the worth of your home. This can be particularly useful for house owners that call for a significant quantity of funds for a specific function, such as home renovations, debt combination, or major expenses like medical expenses or education expenses. Unlike other types of financings, an equity loan commonly supplies lower interest prices because of the security given by the residential or commercial property, making it an affordable borrowing choice for lots of people.

In addition, equity finances commonly give a lot more adaptability in terms of payment timetables and financing terms contrasted to other forms of funding. Overall, the ability to gain access to substantial amounts of cash at lower passion prices with versatile repayment alternatives makes equity lendings a beneficial monetary tool for homeowners seeking to leverage their home's value.

Flexibility in Fund Use

Given the useful borrowing terms connected with equity car loans, homeowners can properly make use of the adaptability in fund use to meet various monetary requirements and goals. Equity loans give homeowners with the liberty to utilize the obtained funds for a vast array of purposes. Whether it's home remodellings, debt combination, education expenditures, or unanticipated medical expenses, the flexibility of equity loans allows individuals to resolve their economic demands effectively.

One trick benefit of equity financings is the lack of restrictions on fund use. Unlike some other types of financings that specify how the obtained money needs to be invested, equity fundings provide consumers the freedom to assign the funds as required. This adaptability makes it possible for house owners to adjust the financing to fit their one-of-a-kind situations and top priorities. Whether it's purchasing a brand-new organization endeavor, covering emergency costs, or moneying a major acquisition, equity financings empower homeowners to make tactical monetary choices aligned with their objectives.

Potential Tax Obligation Benefits

One of the key tax benefits of an equity car loan is the capability to deduct the interest paid on the financing in specific scenarios. In the United States, for instance, interest on home equity financings up to $100,000 may be tax-deductible if the funds are utilized to improve the property securing the funding.

Additionally, utilizing an equity financing to consolidate high-interest debt may additionally bring about tax benefits. By repaying charge card financial debt or various other car loans with greater rates of interest making use of an equity lending, home owners may be able to subtract the rate of interest on the equity funding, possibly saving much more money on tax obligations. It's important for home owners to talk to a tax consultant to comprehend the particular tax implications of an equity financing based on their private situations.

Lower Rates Of Interest

When discovering the economic advantages of equity financings, an additional vital aspect to consider is the capacity for home owners to secure reduced rates of interest - Home Equity Loan. Equity loans typically use reduced rates of interest compared to various other kinds of loaning, such as individual lendings or bank card. This is since equity financings are protected by the value of your home, making them much less risky for lending institutions

Lower passion rates can result in substantial expense financial savings over the life of the loan. Even a small percentage difference in rates of interest can translate to significant financial savings in passion repayments. Property owners can make use of these cost savings to pay off the funding quicker, build equity in their homes quicker, or purchase other locations of their economic profile.

Additionally, lower rate of interest rates can enhance the general affordability of loaning versus home equity - Alpine Credits Canada. With reduced interest expenses, property owners may locate it easier to handle their monthly settlements and maintain monetary stability. By benefiting from reduced passion rates with an equity loan, house owners can utilize their home's value a lot more effectively to meet their financial objectives

Faster Accessibility to Funds

Home owners can speed up the procedure of accessing funds by utilizing an equity lending safeguarded by the value of their home. Unlike other funding options that might include prolonged authorization procedures, equity loans provide a quicker path to acquiring funds. The equity accumulated in a home acts as security, offering loan providers greater confidence in extending debt, which improves the authorization procedure.

With equity lendings, home owners can access funds promptly, frequently getting the cash in a matter of weeks. This fast access to funds can be important in circumstances needing immediate economic support, such as home improvements, medical emergency situations, or debt combination. Alpine Credits Canada. By taking advantage of their home's equity, homeowners can swiftly attend to pressing financial needs without long term waiting periods normally connected with various other sorts of loans

Moreover, the structured process of equity loans converts to quicker dispensation of funds, allowing home owners to seize timely investment possibilities or handle unpredicted expenditures effectively. In general, the expedited access to funds via equity lendings highlights their usefulness and ease for property owners looking for timely financial options.

Conclusion

Unlike some various other kinds of fundings that define how the borrowed cash ought to be invested, equity car loans provide borrowers the freedom to allot the funds as required. One of the main tax benefits of an equity funding is the ability to deduct the rate of interest paid on the lending in certain situations. In the United States, for example, Recommended Site interest on home equity financings up to $100,000 might be tax-deductible if the funds are used to improve the home safeguarding the financing (Home Equity Loan). By paying off credit history card financial obligation or various other finances with greater passion prices utilizing an equity financing, property owners may be able to subtract the rate of interest on the equity lending, potentially saving even more money on tax obligations. Unlike various other financing choices that might involve extensive authorization treatments, equity car loans provide a quicker route to obtaining funds

Report this page